The Competitive Edge for a Modern Vehicle is all About its Software

December 15, 2020

Idan Nadav

Co-founder

Vehicles are now defined by software. Drivers are no longer satisfied with smooth handling, leather seats and satellite radio. They are looking for a connected, immersive experience for the hours they spend commuting in their cars. Today’s drivers are used to having everything available at their fingertips at all hours of the day and they will only get this with a software-defined car.

So What is a Software-Defined Car?

The SW-defined car is essentially a mega-computer on wheels. Its E/E Architecture is based on modular vehicle servers using universal hardware that can be easily updated each year as consumers’ demands for more features and functionality evolve.

The software-defined car is pioneered by a new type of OEM that is in essence a tech company building ‘computer networks on wheels.’ The cars they create are optimized for the user’s connected experience enhanced by their unique software. For these new OEMs, the manufacturing of the vehicle is outsourced while the software is developed in-house.

But how is the software-defined car affecting the manufacturing process in the automotive supply chain?

Vehicle Software is more Prominent

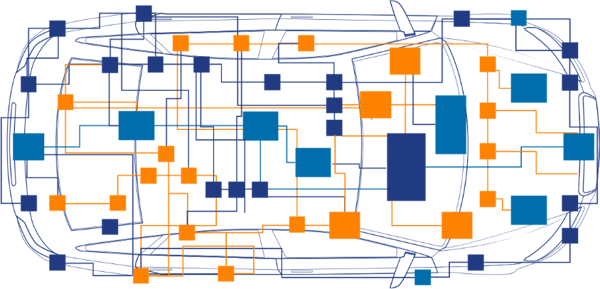

A software-defined vehicle's functionality and features are powered by software. The personalization that drivers crave requires next-gen software. Today’s vehicles have 100-150 ECUs supplied by a multitude of Tier 1s and they are only scratching the surface of personalized technology.

The current hardware architecture and vendor management is becoming a nightmare for OEMs.

The trends towards autonomous, connected, and electric vehicles will require much more software. According to the McKinsey & Company’s Automotive software & electronics report, software developed for functions such as infotainment, security, and connected services will reach:

- $14 billion USD by 2025

- $18 billion USD by 2030

For overall software development, the figures are even higher:

- $63 billion USD by 2025

- $84 billion USD by 2030

The necessary leap forward can only be accomplished by overhauling a car’s E/E Architecture.

Vehicle Maintenance is Simplified

In general, maintenance is a matter of developing improvements and fixes, testing them, and then upgrading the software. As software becomes more dominant in cars, a next-gen Zonal E/E Architecture with fewer components that are multi-functional and decoupled from the hardware will be necessary.

High-performance vehicle servers will enable modular SW components for vehicles which will allow the reuse of code across vehicle models and ECUs. This will make the SW maintenance much more manageable with limited trips to the garage and Over-the-Air (OTA) updates available in a secure environment.

Hardware is Consolidated

OEMs and Tier 1s are experts in designing and building components for mass production. But integrating the hardware and software needed for today’s advanced functions and features are proving to be a struggle. Volkswagen, for example, plans to release 7,000 factory workers by 2023 while hiring 2,000 software developers for their new Volkswagen’s Car Software Organization. Daimler also opened a software division: Daimler’s MBition.

A single vehicle usually requires dozens of ECU suppliers who also must supply their own software for each ECU. Maintenance and upgrades are a managerial headache. As cars incorporate more software, this system will soon be intolerable.

The shift to Service-Oriented Architecture (Automotive SOA) has led to a new tier of software vendors that are changing the traditional supply chain. The Cybertech Tier consolidates and integrates high-performing components and applications from different suppliers that run on multi-purpose, universal hardware servers. It provides OEMs and Tier 1s immediate expertise for consolidating hardware and software components into integrated products and virtualizing computing systems

Secure by Design

What is a SW-defined vehicle if it is not protected from cyber attacks? It’s a sitting duck. After all, if the car is defined by software and relies on software updates, the potential for an attack is enormous. There must be protection at each stage of the car’s lifecycle: from development to production to the highway.

That is why the new generation of software defined vehicles have their cyber security mechanisms laid out from pre-development, all the way through the implementation of every layer in the car’s software (and hardware). That is the meaning of ‘Secure by Design.’ It takes advantage of modern foundational security solutions that are embedded into a Service-Oriented Architecture with a supplemental high-speed communication backbone, like Ethernet.

A software-defined vehicle cannot live without OTA (Over-the-Air) updates. The Communication Lockdown is a method that provides 3 layers of security to prevent cyber attacks and verifies that all software upgrades and messaging are legitimate.

Hardware is Modular & Reusable

The SW-defined vehicle provides modularity. Virtualization of software components over multi-purpose vehicle servers will allow for full-modularity and re-use of software and hardware.

Interchanging parts will fit multiple platforms and will be compatible with different model years. Plug & play ECUs will be installed at will with ease and this will open a new world for OEMs to supply a software functionality catalogue (like a factory “app store”).

Modularity allows connecting/disconnecting devices in real time to an existing ECU without restarting the system. It also provides capability for secure over-the-air updates and initiates a huge decrease in on-site maintenance and vehicle downtime.

Personalization to be Implemented through Software

In order for ‘personalization’ to be economically viable for car manufacturers, they need to evolve to Zonal and SOA based architectures for hardware and software. This will allow for car vendors to have a common server infrastructure for multiple car models. They will be able to differentiate between models and provide more specific personalized experiences - to apply software modules to those common servers (Vehicle Servers or Vehicle Gateways).

Moving to a more common server based E/E Architecture will simplify and significantly reduce the cost of manufacturing for OEMs.

Thinking Differently to Succeed

Automakers need to consider shifting their business model from car manufacturers that offer software to software companies that offer cars.

When Microsoft CEO, Steve Ballmer, was asked about the newly released iPhone, he said, “This is not for business people because it has no keyboard.”

How wrong he was. iPhone is now on its 14th generation with the iPhone 12 Pro and sells for about $1,000 per unit. Why? Because Apple thought differently and didn’t include a “standard” keyboard on their phone.

OEMs need to start thinking differently about their products. This will pave the way for them to create highly-personalized, software-defined vehicles that deliver exactly what consumers want: customized and personalized driving experiences.

Aftermarket Opportunities

With a SW-defined vehicle, car dealerships will be able to provide their customers with the newest gadgets and upgrades, while also increasing their own revenue streams. For example, using cybertech technology, a car will report to the dealership that it’s due for maintenance and the dealership can then send a personalized message to the car’s infotainment system.

Nio, China’s #1 electric vehicle manufacturer, enhances drivers’ experiences with physical cafes and the equivalent of an “app store” for their customers. Nio boasts 800,000 users but has far fewer cars on the road. (Read: their subscribers greatly outnumber the number of cars actually sold.) The landscape is empty and fertile for manufacturers to create after-sale revenue streams with apps, software-based features. . .even exclusive cafes. Drivers can access services, assistance, and even upgrades while they are on the road.

Cybertech Tier is Paramount

Software-defined vehicles are the next automotive revolution, and it’s happening now. New tech companies like Tesla, Nio, Byton, Faraday and other promising emerging startups are attracting talent from the tech industry to support their path to the new generation of vehicles.

The traditional OEMs are also trying to adapt and react, and some of them are hiring software engineers by the thousands. It is an enormous challenge for traditional OEMs to attract top talent in the fields of electronics and software development due to the nature of these companies which are typically seen by the tech community as conservative, bureaucratic, hierarchical, and slow to adopt changes.

This puts traditional OEMs at a huge disadvantage when competing against “start-ups” to hire hot, new engineers. The result is the talent they hire is usually not on the “A-List.”

Some traditional OEMs are coming to realize this. They are relying on the Cybertech Tier suppliers to complement their in-house engineering expertise in the F.A.S.T.E.R. fields. This allows these traditional OEMs to keep up with the newer players and leap forward to the era of software-defined cars while leveraging their huge legacy.